A panel of Iowa lawmakers met this week to review the dozens of state tax credits that are available.

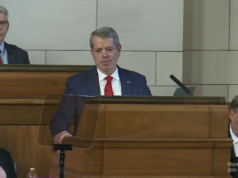

Republican Pat Grassley of New Hartford, the Speaker-Select of the Iowa House says some credits are decades old and it’s hard to know how they’ll impact the budget from year to year.

OC…….be looking at.” :08

Grassley cautions that any changes to tax credits will be hard to pass because he expects strong opposition from interest groups.

The State of Iowa paid out more than 200 million dollars in tax credits during the last state fiscal year.

Some of the largest awards go to large companies through tax credits for research, employment and training programs.

Democratic Representative Chris Hall of Sioux City, says that cuts into revenue that could go toward education or health care.

OC………is good enough.” :07

It’s unclear how the committee will move forward from here.

The Republican co-chairs of the group would not commit to another meeting before the 2020 legislative session starts in January.